Payoff Quotes/Statements

We have several convenient options to obtain loan payoff information:

If you are looking for loan payoff information for specific loans, going through your online account will be the quickest and easiest way to retrieve a payoff quote. Borrowers can also contact us by phone and request we send a statement with the requested payoff information.

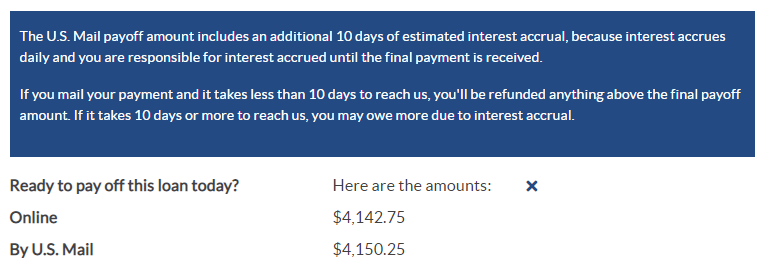

To locate loan payoff information in your online account, you will need to login then click on “Loan Details” in the navigation. From here, select the loan that you would like to view. As shown in the example image below, you will see an “Online” and “By U.S. Mail” payoff quote available for that loan. If you click on the info icon, additional information about how those numbers are calculated will be explained.

The U.S. Mail payoff amount includes an additional 10 days of estimated interest accrual, because interest accrues daily and you are responsible for interest accrued until the final payment is received.

If you mail your payment and it takes less than 10 days to reach us, you’ll be refunded anything above the final payoff amount. If it takes 10 days or more to reach us, you may owe more due to interest accrual.

Ready to pay off this loan today? Here are the amounts:

Online $4,142.75

By U.S. Mail $4,150.25

If you are looking for a total loan payoff for all your loans, calling our Integrated Voice Response (IVR) system will be the quickest and easiest way to retrieve a payoff quote.

Call 1-855-337-6884

Select Option 1 (to Make a Payment)

Select Option 5 (to Calculate a Payoff)

Borrowers may also speak with a customer service representative to request a payoff statement be sent to them.

How to Submit a Payoff Payment

After obtaining your payoff quote, the next step is to submit a payment to Edfinancial via one of the following methods:

Log into your online account and select the “Custom Pay” dropdown button. If you want to pay off all your loans select “Auto Allocate”, and sum up the Current Balance for all your loans for the payment amount. If you want to pay off specific loans, select “Specify for Each Loan” and fill in the Current Balance amount for each loan you want to pay off.

If you need to post-date your online pay off payment, it is recommended that you wait until the day you are able to submit the payment to prevent any daily interest accrual on each loan from leaving a small remainder on your account.

If you have Auto Pay set up, your payoff payment must post 3 business days prior to the next scheduled payment draft date in order to prevent the payment from being drafted.

You can mail a check or money order to our payment address to pay your account in full.

US Department of Education

P.O.Box 790322

St. Louis, MO 63179-0322

If you have Auto Pay set up, your payoff payment must post 3 business days prior to the next scheduled payment draft date in order to prevent the payment from being drafted.

Important

To avoid significant delays, it is very important to mail your payments to the correct address. Your payment mailing address may be different, depending on your loan program. Please check your billing statement, log into your online account, or contact us to get the correct payment mailing address for your loans.

Payoff payments can be submitted via phone.

Call 1-855-337-6884

Select Option 1 (to Make a Payment)

If you have Auto Pay set up, your payoff payment must post 3 business days prior to the next scheduled payment draft date in order to prevent the payment from being drafted.

How to Verify Your Loan is Paid in Full (PIF)

We will notify you in writing with a paid in full letter approximately 20-25 days after the loan(s) is updated with a zero balance. If you need written confirmation of your account balance, you can log into your online account and view/print a your account information after the final payment has posted to your account.

Once you have logged into your online account, select “Tools & Requests”, then choose the “Printable Account Information” option to view/print the letter.

How to Save on Interest and Pay Off Your Loan Faster

Discover how much faster you can pay off your loan(s) by making extra payments. The quicker you pay down your principal balance, the more interest you can save in the long run. You’ll also pay off the account faster.

It’s easier than you think! Use the Loan Simulator on StudentAid.gov to see how much faster you can pay off your loan(s) by paying an extra amount. You will need some basic loan information to use the calculator:

- Loan Details: Your loan balance(s) and interest rate(s) can be found in this section. The information can also be found on the “Printable Account Information” letter that can be located under “Tools & Requests”.

- Repayment Term: You can view your current repayment plan and estimated payoff date in your online account by choosing “Loan Details” and selecting the loan you want to view.

Loan Payoff FAQs

After your loan reaches a zero balance due to a payoff payment, that loan will be reported as “Paid In Full” to the nationwide consumer reporting agencies at the end of that month.

Unfortunately, we are unable to accept settlement amounts. You are responsible for repayment of the principal balance and any outstanding interest.

It depends on your due date. If your payoff payment posts at least 3 business days before your due date, we should not draft funds.

No, all credit reporting history will remain the same in accordance with the Fair Credit Reporting Act.

All payments take one to two business days to process. If the payoff payment was made on Friday before 11:59 pm ET, then it will be posted with Friday’s date and the account will be paid in full as soon as the payment finishes processing.

You can find this by logging in to your online account, selecting the “Loan Details” tab, then selecting the loan that you want the expected payoff date for based on your minimum monthly payment. The “Repayment Plan”, “Repayment Start Date” and “Estimated Payoff Date” will be listed in the first section of each loan detail page.