How is student loan interest calculated?

Most student loans (including all federally guaranteed loans) use a method of interest accrual known as “simple interest.” The difference between simple interest and compound interest (the type of interest that accrues on most major credit cards) is that simple interest is only calculated on the principal balance, not on the previously accrued interest.

To calculate your daily interest accrual, use the following formula:

(Current Principal Balance x Interest Rate) ÷ 365.25 = Daily Interest

This formula says to multiply your current principal balance by the interest rate and then divide the result by 365.25. The result is your daily interest accrual, or how much interest you would pay for one day. You can multiply this number by a specific number of days to calculate your interest accrual over a certain amount of time.

Example

Current Principal Balance: $20,000.00

Interest Rate: 4.50%

Days of Interest Needed: 30

Just plug in the numbers to calculate the approximate 30-day interest accrual:

[(20,000 x .045) ÷ 365.25] x 30 = $73.92

You may view your unpaid accrued interest via your online account.

What does it mean when interest is capitalized? When does it occur?

Interest accrues daily on your loan including times when a payment is not required to be made on a loan such as deferment, forbearance, grace, and in-school statuses. Accrued interest is usually capitalized (added to the principal balance) when the loan goes into repayment thereby increasing the total outstanding balance due and the amount of interest which accrues daily.

Because interest continues to accrue on the principal balance if a payment is not made, any future interest that accrues after capitalization will be based on the new outstanding principal amount (previous principal balance plus capitalized interest). Therefore, capitalization increases the total cost of your loan.

You can avoid the cost of capitalization by making payments during any period when they are not due. For certain federal student loans, including unsubsidized, Parent PLUS and GradPLUS loans, federal law permits unpaid interest to be added (capitalized) to your principal balance at certain times during your loan term. These times where unpaid interest may be capitalized can include after your grace period, at the end of deferment, and at the end of forbearance.

For private loans, consumer law permits unpaid interest to be capitalized at the frequency stated in the terms of the agreement that you signed when you obtained the loan.

I’d like to make a payment only to interest. How can I do that?

If your payments are currently suspended due to deferment or forbearance, it will benefit you to continue making payments on the interest that accrues to avoid capitalization. To determine the amount of unpaid interest, you will need to log into your online account and select review your loan details. If you have several loans, you can select each one to see the unpaid accrued interest.

Your Online AccountAny payment you make on a loan will, per regulation, be applied first to outstanding interest, unless late fees* are assessed, then your principal balance. Interest accrues daily; therefore, the amount of unpaid accrued interest changes daily. Any amount paid toward a loan that is higher than the interest accrued and late fees (if applicable) will be automatically applied to the principal balance on the loan.

*The U.S. Department of Education does not assess fees for late payment of Federal Direct Loans.

What fees could potentially be added to my account?

Some lenders charge a late fee* if you do not make your payment on time. Usually, these fees are charged as a percentage of your monthly payment. Many lenders provide for a grace period before they charge a late fee. For example, if the lender’s grace period is five days, a late fee would be charged six days after the payment is due, if a payment has not been received.

*The U.S. Department of Education does not assess fees for late payment of Federal Direct Loans.

Can I pay more than my minimum scheduled monthly installment amount each month?

Yes, you can pay extra at any time, and there is no prepayment penalty on your federal student loans. If you are setup on Auto Pay and would like to pay more than your minimum scheduled monthly installment amount each month, you can update your Auto Pay information through your online account.

If you wish to make extra payments without Auto Pay, you can submit one-time payments at any time through your online account. You can click on the “Make a Payment” section, and choose how you would like the payment allocated to your account. You can select “Auto Allocate” to have your payment applied based on the standard allocation method, or you can select “Specify for Each Loan” to apply specific amounts to specific loans.

If you would like to set up your payment instructions online, you can do so through your online account. Once you log in, under the “Account Profile” section, locate the “Payment Directions” section. You can edit this section to specify how you would like overpayments and underpayments applied, as well as if you would like your due date advanced. Please note you can also include one-time or recurring special payment instructions by mailing them with your payment, by contacting us at 1.855.337.6884, or by visiting Edfinancial.StudentAid.gov/Contact.

Your Online AccountCan I deduct the student loan interest I paid on my tax return?

See our Tax Information page for more information. You may be able to deduct interest paid on eligible student loans. Edfinancial’s customer service representatives cannot provide tax advice. If you have questions about allowable deductions for the interest or origination fees paid on your loan(s), please contact the Internal Revenue Service (IRS) toll free at 1-800-829-1040, or a tax professional.

How can I find out what my loan payoff is?

There are several options available to obtain loan payoff information.

Your Online Account

If you are looking for loan payoff information for specific loans, going through your online account will be the quickest and easiest way to retrieve a payoff quote.

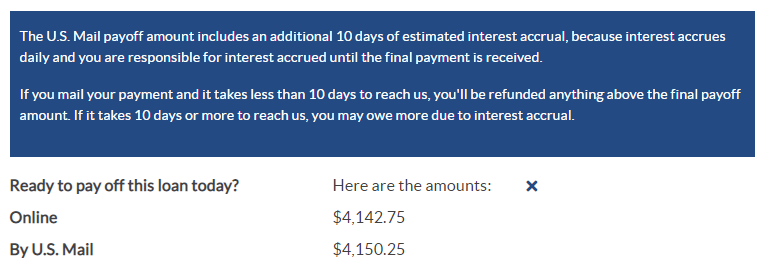

To locate loan payoff information in your online account, you will need to login then click on “Loan Details” in the navigation. From here, select the loan that you would like a loan payoff quote for. As shown in the example image below, you will see an “Online” and “By U.S. Mail” payoff quote available. If you click on the info icon, additional information about how those numbers are calculated will be explained.

Phone

If you are looking for a total loan payoff for all your loans, calling our Integrated Voice Response (IVR) system will be the quickest and easiest way to retrieve a payoff quote. Dial 1-855-337-6884; choose option 1 (to Make a Payment) and then choose option 5 (to Calculate a Payoff).

Check out our Loan Payoff page for additional information.

Loan PayoffNeed help?

We Are Here For You

Representatives are available Monday 8am - 11pm, Tuesday - Friday 8am - 8pm, Saturday 10am - 2pm Eastern Time